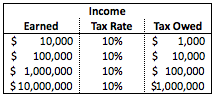

Conversely, progressive tax rates mean that high income individuals pay at a higher tax rate than low income individuals. For example, if everyone has the same tax rate (e.g., flat tax), then high income individuals will pay more tax than low income individuals simply because their incomes are higher. This is not to be confused with the simple fact that high income individuals pay more tax because their taxable incomes are higher. It is based on the premise that high income individuals should pay tax on a higher percentage of their incomes than low income individuals. The major progressive tax rate is the individual income tax. Progressive tax rates are common in the United States.

0 kommentar(er)

0 kommentar(er)